Several analysts believe that DeFi, or decentralized finance, is the next big thing in the bitcoin sector. Yet many investors are becoming more interested in this sector. In this post, we will define decentralized finance and discuss the potential it may provide. As a result, a full-fledged guide to this very intriguing crypto field should be created, from which you, as a reader, should gain a wealth of knowledge.

What is DeFi, or decentralized finance?

DeFi is here, and DeFi is there. It seems that the whole crypto industry is now discussing decentralized finance and philosophizing about the unimaginable potential of this amazing movement. Nevertheless, only a few address the most fundamental issue about this phenomenon: What is DeFi? As a result, we aim to shed some light on the situation and dare to provide a definition.

What is DeFi? Definition and Explanation

DeFi is an acronym for Decentralized Finance, which means “decentralized finance.” More specifically, it is a kind of service digitalization in the financial industry.

DeFi, or decentralized finance, enables a whole new method of investing, borrowing, or lending money without the intervention of a central authority. The blockchain and smart contracts enable this system.

But, the services have the potential to go far further. Lending, yield farming, and staking are examples of modern crypto market trends.

In this regard, DeFi may be seen as an effort to bring the conventional international financial market into the twenty-first century and develop technology solutions for it. At this time, one or both may be interested in startups and fintechs, which are on a similar path.

Until now, the technology has mostly been deployed on the traditional Internet, but blockchain technology could provide greater security and more stable software. The Ethereum blockchain, in particular, is seen as a forerunner in terms of providing infrastructure for DeFi services.

Therefore, it immediately becomes evident that there can’t be a single response to the question “What is DeFi?” since the definition includes numerous answers. On the one hand, there is discussion of the technical advancement of the smart contract, but it is also a financial industry trend.

How exactly does DeFi work? The Ethereum blockchain and smart contracts explained

The blockchain serves as the foundation for decentralized finance. To comprehend DeFi, you must first have a fundamental grasp of how the Ethereum blockchain operates.

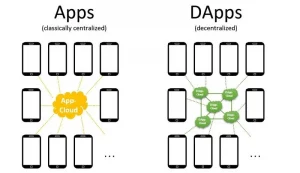

Ethereum is fundamentally a framework for running decentralized applications (dapps), or programs that do not rely on a third party to operate.

Instead, they are driven by Ethereum blockchain-stored smart contracts; “intelligent” in this context denotes the automatism of self-executing contracts (smart contracts).

Using smart contracts, several apps and services have already expanded to the Ethereum blockchain. Intelligent contracts enable completely automated inquiry and confirmation of online purchases, as well as interest transactions and investments.

One of the primary benefits of decentralized apps is that they are not intended to be trusted. This means you don’t have to rely on a third party to keep your data secure or carry out transactions effectively. Instead, all data and transactions are kept on the public and transparent Ethereum blockchain. Of course, the whole thing can be brilliantly converted into services, allowing for an efficient and quick online solution for a variety of applications.

Additional information on possible DeFi applications will be provided later on this page. Smart contracts are also available via the so-called D’Apps, for which the Ethereum blockchain was designed.

There is a big demarcation region here, for example, for Bitcoin, which is less about practical applications. DeFi has really given Ethereum a significant boost, so Ether is well on its way to resuming its former glory. After all, Bitcoin is and will continue to be the primary driving force behind the whole network.

The more suppliers that are represented here and can offer their services, the more valuable Ethereum is.

Classic finance vs. fintechs vs. DeFi

It may be necessary to delimit the various regions. Traditional finance is often centered on banks, which provide services and contracts in conventional branches. Loans are granted, credit cards are provided, and stock trading is made available.

The issue with this time-honored banking approach is one of time and money. But compared to current apps, a bank branch personnel can hardly keep up with the inexpensive and rapid solutions that include fintechs or DeFi.

DeFi applications

1. Lending

Lending is nothing more than traditional lending. In the future, blockchain should make it considerably simpler and quicker to get a loan.

Thus far, there are just a few suppliers that deliver cryptocurrency in a couple of seconds. The technology acts as a credit representative, checking collateral and the contractual partner’s solvency.

2. Borrowing

This is less about a lucrative method of lending money and more about providing free services. Of course, the blockchain can also find solutions here via DeFi and keep payment providers and receivers up-to-date at all times.

3. Decentralized exchanges

In most situations, cryptocurrencies are decentralized, meaning they are not located in a single place. Such apps and businesses may be found on the blockchain. Historically, various stock exchanges have collected on the chain to provide their services. Thus far, it has been shown that this works.

Yet, it should be highlighted that laws play an important role in the financial industry, which such exchanges cannot accomplish in most circumstances.

4.Trading

The same holds true for derivatives and trading. Since there are now various DeFi software and apps for this, users may access several sorts of content with the right software.

Cryptocurrencies, but also products like trading cards or digital works of art, may be exchanged in this manner.

5. Payments

Payment is one of the most practical areas of application. In the future, payments will become more digital. Several market participants have previously forecast the demise of currencies. Thus, it stands to reason that DeFi would also accept such digital forms of payment.

Nonetheless, consumers should not be able to detect any significant differences between the application and traditional suppliers. The slogan is “quick and inexpensive.”

6. Yield farming

Yield farming is a method for generating a set interest rate using DeFi. You employ the stated techniques to collect a return in this manner.

This may be accomplished, for example, by investing in cryptocurrencies or lending them out.

So, the English phrase yield, i.e., yield, provides consistent payments and revenue.

7. Liquidity mining

Yield farming is strongly connected to liquidity mining. Hence, mining is basically a method of creating new bitcoin tokens. Miners that supply the network with the required liquidity, i.e. park their coins, are rewarded with specific coins in the DeFi region. This is where the phrase “liquidity mining” originates.

Investing in DeFi: How to Get Involved in Decentralized Finance

In truth, there are several ways to take part in the DeFi phenomenon. On the one hand, you may simply invest in Ethereum and purchase it using PayPal, for example.

On the other side, Ethereum mining is an excellent approach to getting the tokens that are critical to the overall operation of the blockchain. Therefore, you don’t invest directly in DeFi, but rather in the technology’s infrastructure.

Another alternative is to invest in DeFi tokens on your own. This inherently raises some risk since they are frequently tiny, unknown enterprises with unpredictable outcomes, but it also boosts potential benefits. This might be seen very nicely at Compound in 2020.

DeFi conclusion: what could the future look like?

DeFi is currently in its early stages. Eventually, more applications will appear on the market that aim to outperform the large banks. In reality, it is still uncertain if the DeFi campaign will be successful in the long term. Cryptocurrency is and will continue to be a very speculative investing industry.

Still, DeFi Coin and Lucky Block are two excellent initiatives that should be investigated further. Here is where exciting new opportunities meet established communities. This should lay the groundwork for cryptocurrency’s future success.

- Recommended broker