Although Bitcoin’s price fluctuations may appear erratic, the same underlying factors that affect traditional financial markets frequently influence them.

Some analysts argue that Bitcoin (BTC) acts as a safeguard against global financial turmoil, citing it as a hedge against inflation and a reliable asset amid uncertainty. However, the media holds a different perspective. Numerous news articles suggest that Bitcoin is susceptible to external market shocks and other factors that do not impact conventional financial instruments, such as international regulations and the influence of social media.

In this article, we will provide a brief overview of the primary drivers that can either trigger a sharp increase or a steep decline in the price of Bitcoin.

Market Events

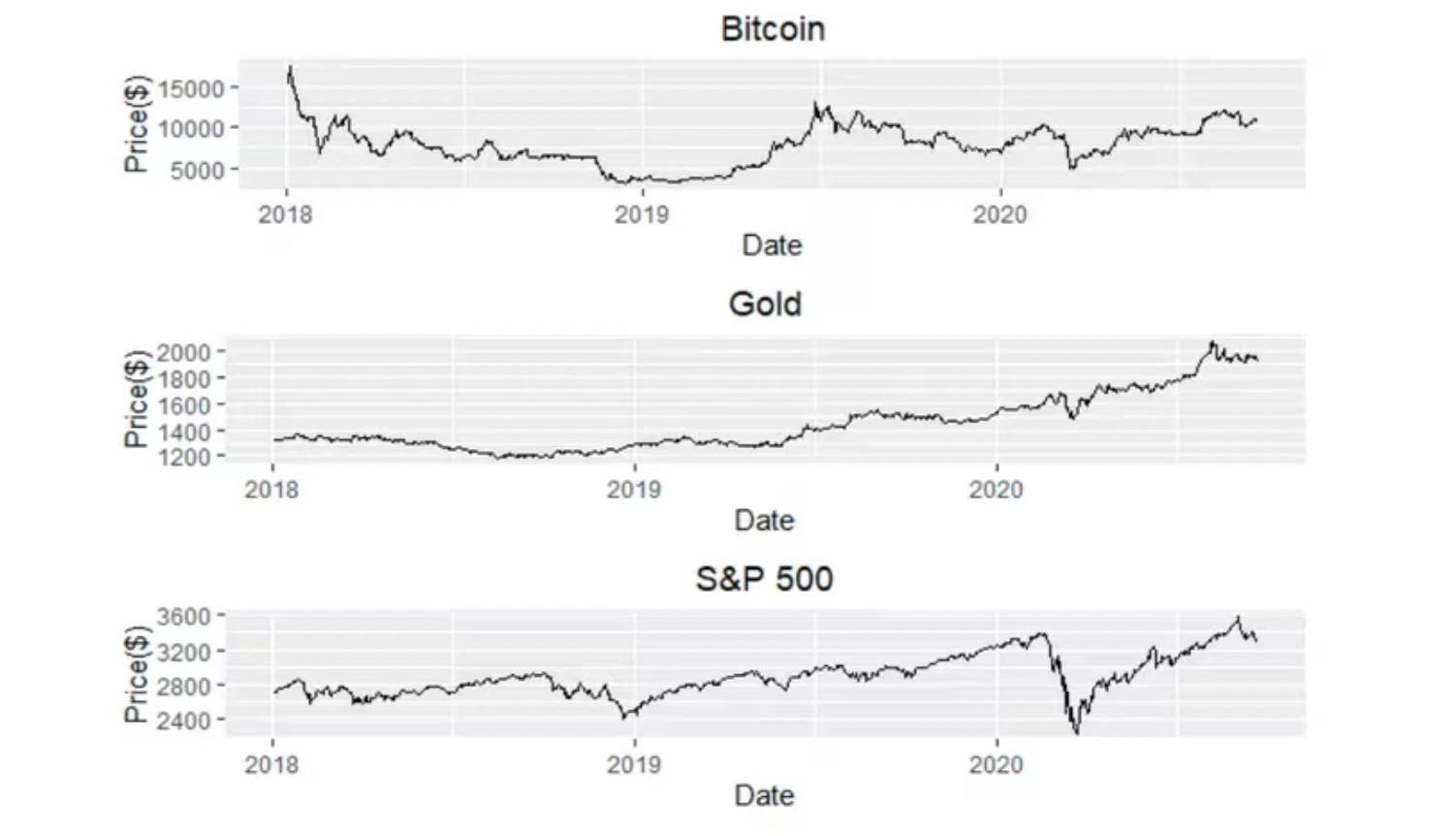

The cryptocurrency market frequently experiences declines in sync with the global financial landscape. For instance, when the COVID-19 pandemic wreaked havoc on global markets in March 2020, Bitcoin followed suit and underwent a significant crash. Within just one week in mid-March, Bitcoin’s value plummeted by 57%, reaching a low of $3,867. Subsequently, similar to the stock market, Bitcoin rebounded and emerged even stronger, ultimately achieving all-time highs the subsequent year. Analysts attribute this resurgence to several factors, including the surplus of leisure time and disposable income available to some retail traders during the pandemic, as well as the resilience of the stock market.

Bitcoin’s response to various market shocks is notable. For example, in late 2021, Bitcoin saw a 6.9% drop when concerns arose over the potential collapse of Evergrande, the Chinese real estate behemoth. It experienced a similar decline when Didi announced its intentions to delist from the New York Stock Exchange. In a broader context, Bitcoin has demonstrated a positive correlation with inflation, rising alongside the prices of consumer goods and raw materials.

While it’s impossible to enumerate all the economic shocks affecting Bitcoin, there is substantial evidence suggesting that Bitcoin does, to some extent, parallel global markets. A 2020 study on Bitcoin volatility in the Journal of Economic Dynamics and Control revealed that most scheduled U.S. macroeconomic news releases have limited influence on Bitcoin’s volatility. However, the situation becomes more turbulent when forward-looking indicators, such as the consumer confidence index, are published.

The exaggeration of these shocks and the amplification of volatility are often a result of systemic overleveraging. Leveraging involves traders borrowing capital from exchanges to amplify their investment potential. Instead of trading with just $1,000 of their own funds, some exchanges have allowed traders to borrow up to 100 times their initial deposit, potentially enabling trades worth up to $100,000. Nevertheless, this high level of borrowing comes with substantial liquidation risks.

When a large number of heavily leveraged traders all bet on Bitcoin moving in the same direction, it creates an opportunity for major investors (whales) to manipulate Bitcoin’s price in the opposite direction. This triggers a chain reaction of liquidations, causing Bitcoin’s price to plummet and resulting in substantial losses for over-leveraged long traders. Subsequently, these whales can acquire Bitcoin at a significantly reduced price, profiting at the expense of the “rekt” traders.

Surprisingly, weekends also have a noteworthy impact on Bitcoin’s price volatility. With fewer traders actively monitoring the markets during weekends, there is reduced resistance when prices decline and less profit-taking when Bitcoin surges. This situation often leads to more substantial price fluctuations in both directions.

Global Regulatory Impact

The influence of international regulations on Bitcoin’s price is profound, as it determines the accessibility of markets, the establishment of companies, and the operational scope for Bitcoin miners. While several nations, including the United Kingdom, Thailand, and India, wield direct influence over Bitcoin’s valuation, the two major markets with the most significant impact are the United States and China.

A substantial drop in Bitcoin’s value, from nearly $65,000 in April 2021 to approximately $35,000 by mid-June, can be largely attributed to China’s stringent measures against Bitcoin mining. The announcement from the Chinese government in September 2021, declaring cryptocurrencies illegal, led to a 5.5% decline in Bitcoin’s value.

In the United States, Bitcoin’s price is responsive to regulatory and legislative developments. For instance, in 2021, President Joe Biden’s infrastructure bill had a detrimental effect on Bitcoin’s price, creating challenges for decentralized wallet companies. These companies would be required to report tax-related data about their customers, which, due to its nature, they typically do not collect.

However, it’s not all negative. Bitcoin also experiences positive reactions to favorable news. Anticipations of the U.S. Securities and Exchange Commission’s approval of a Bitcoin futures exchange-traded fund led to a price increase of approximately $3,000 in October 2021.

Influences from Conventional Finance

The dynamics within traditional finance circles can either propel or dampen Bitcoin’s price, largely depending on the ease with which financial hubs like Wall Street can embrace Bitcoin. Actions that facilitate greater Wall Street involvement, such as major banks offering Bitcoin services to their clients, often coincide with price surges. Conversely, unfavorable remarks from prominent Wall Street figures can incite concerns among traders.

Bitcoin has frequently experienced price increases following announcements by major companies that they have incorporated Bitcoin into their balance sheets. Notable examples include MicroStrategy and Tesla’s investments in Bitcoin, both of which ignited significant surges. On the flip side, the overall market capitalization of the cryptocurrency sphere plummeted from $2.43 trillion to $2.03 trillion when Tesla, under CEO Elon Musk, declared in May 2021 that it would no longer accept Bitcoin for transactions, citing environmental concerns.

Furthermore, traditional financial instruments can exert a notable impact on Bitcoin’s market price, with particular emphasis on derivative products that represent contracts linked to the underlying price of BTC. As mentioned earlier, leveraged futures trading often triggers substantial price fluctuations, but the same holds true for other products like cryptocurrency options. In essence, crypto options provide investors with the right, though not the obligation, to buy or sell the underlying asset (in this context, Bitcoin) at a specified price (referred to as the strike price) before, or on, a designated date.

The simultaneous expiration of a substantial number of out-of-the-money (OTM) Bitcoin options can at times influence Bitcoin’s market volatility. OTM denotes instances where options do not yield profits. For instance, a call option (granting the right to purchase the underlying asset) is considered out-of-the-money when the strike price (the agreed purchase price of the underlying asset) exceeds the current market price.

Before expiration, it is customary for significant investors, such as market makers, to hedge using the underlying asset to mitigate extended losses if Bitcoin’s price takes a contrary turn.

The Influence of Social Media

The boundaries between traditional finance and the sway of social media often become indistinct when tech CEOs actively engage on these platforms. Notably, retail investors exhibit heightened sensitivity to remarks made by prominent influencers regarding Bitcoin. A striking illustration of this was witnessed when Elon Musk altered his Twitter bio to include “bitcoin,” causing a remarkable surge of over 20% in Bitcoin’s value. This alteration signaled to retail investors that Musk might be considering an investment in Bitcoin, a move he subsequently made through Tesla. This trend mirrors the CEO’s significant impact on other assets, particularly Dogecoin.

Certain analysts have attempted to leverage social media as a predictive tool for asset prices. In a 2021 study, two South Korean researchers found that posts related to Bitcoin become more frequent when its prices are soaring and less frequent during periods of decline. In a separate 2019 research paper by Indian analysts, it was established that both negative and positive social media posts correlate with fluctuations in Bitcoin’s price.

Conclusion

The world of Bitcoin is complex and dynamic, where numerous interconnected factors influence its price. Traditional finance, market events, international regulations, and the sway of social media all play pivotal roles in shaping the trajectory of this digital asset.

Market events, like the COVID-19 pandemic and economic shocks, have demonstrated the capacity to trigger both significant crashes and remarkable recoveries in the Bitcoin market. These events highlight the adaptability and resilience of this cryptocurrency.

Global regulations have a substantial impact on Bitcoin’s accessibility and stability, with China and the United States standing out as major players in this regard. Regulatory decisions can lead to substantial price fluctuations, both positive and negative.

Conventional financial instruments and products, such as derivatives and leveraged trading, have been shown to amplify price swings, often adding to Bitcoin’s volatility. Additionally, the influence of social media, especially when wielded by influential figures like Elon Musk, can have a pronounced effect on Bitcoin’s valuation.

In the end, the price of Bitcoin is a result of a delicate interplay of these factors, reflecting the evolving landscape of the cryptocurrency market. Understanding these dynamics is essential for investors and enthusiasts seeking to navigate the world of Bitcoin successfully.