$63,000 is a significant sum of money that a lot of people have fantasized about seeing in their most recent bank account, but in the world of cryptocurrency, it also represents a number that is one of a kind. On April 14, 2021, Bitcoin hit an all-time high of $63,000, which shocked the world’s financial community and made many buyers more confident in the world’s largest cryptocurrency. Even though digital currencies are steadily growing, people are still not too interested in them. This article is also meant to answer the question “What is Bitcoin?” and help you understand the “father of all cryptocurrencies” by telling you about its history, how it works, and why you should buy it.

A clear explanation of “What is Bitcoin”?

A Bitcoin cannot be “felt” like a euro coin. Instead, it is pure computer code that has a significant edge over all other currencies: the payment system is not centralized. This implies that Bitcoin transfers do not require banking organizations to serve as intermediaries. This makes cryptocurrencies more secure and difficult to manage than traditional money.

The most important facts

- Year of Creation: 2009

- Inventor: Satoshi Nakamoto

- Course on June 10, 2021: $54,237.52

- Market capitalization: $1,019,783,554,742

- Trading volume per day: $48.839,942,782.

- Transactions per day: 313 947

- The average block size is 1.26MB.

- Blockchain size (as of July 2021): 401 GB

- Consensus algorithm: proof of work

- Maximum amount-21,000,000

- The market rank of all cryptocurrencies is: #1

- Market dominance: 44.73%

Our broker and exchange comparison enables you to purchase cryptocurrency with the lowest fees

Broker | Evaluation | Functions | Benefits | Spread | Leverage | Total Fees | Visit Provider |

|---|

4 | CFDs and forex, Stocks, ETFs, Crypto |

| Variable spread | 30:1 and other | 1% for buying or selling crypto |

4.8 | CFDs: Crypto, Indices, Forex, Commodities, Shares, Options, ETFs |

| Tight Spreads | 1:300 | No internal deposit fee |

| 4.4 | • FX

• Metals

• Indices

• Cryptocurrencies

• Stocks

• Energies

|

| Tight spreads starting from 0.0 | 1:400 | Depending on payment method |

4.2 | 49 global currency pairs, commodities, index CFDs, stock CFDs, ETFs, metals, commodities, energy |

| Tight Spreads | 1:1 – 30:1 | No fees |

4.0 | 1000+ financial instruments, including Foreign Exchange, Commodities, Indices, Share CFDs, Cryptos, ETFs, and Bonds |

| 1.27 | 1:500 | $3 per side for every 100,000 units |

3.9 | 70 crypto-pairs, 49 forex pairs (usdzar as well), 5 metals, 26 Indices, 130 stocks, 6 oil and gas, 6 agriculture assets |

| Spreads from 0.00 | 1:999 | 3% + inactivity fee |

The ultimate guide to how Bitcoin works

The History of Bitcoin

If you are interested in Bitcoin, you will be unable to escape the name Satoshi Nakamoto. Even though this is probably a pseudonym, Nakamoto is often thought to be the person who made Bitcoin.

In November 2008, a document referred to as the “Bitcoin Whitepaper” was published. It is widely believed that individuals from Japan were responsible for writing this document. It is an 8-page document that explains Bitcoin’s background, basics, and ideas in a way that isn’t always easy to understand. Even today, it is considered the most important piece of writing for learning and understanding the basics of cryptography, even though many places do not explain these basics in a way that is easy for beginners to understand.

Bitcoin blockchain technology

In addition to the Bitcoin Whitepaper, which only describes and specifies the cryptocurrency, the word blockchain is probably the most essential concept to understand when trying to get to the bottom of cryptocurrencies.

One way to think about the blockchain is as an essential database, without which the idea of Bitcoin would be completely pointless. So, it can do some of what a bank does by making sure a transaction between two parties happens without a third party and by processing it in a way that can’t be changed. It does this by making sure that everyone involved in a transaction can see what everyone else is doing. It is possible by decentralization, which stops manipulation.

But how exactly does blockchain technology work in the case of Bitcoin? The blockchain consists of many blocks that connect to each other and integrate into a chain.

Each block has three parts. Data, which is the information about the transaction between the two parties. A hash, which is a digital identifier of the data. And the hash of the block before it, which links the blocks together to make a chain. The hash’s role as an irreversible form of encryption and is very important since it acts like a lock on a door behind which the data in the block hides.

But where there is a lock, there must also be a key that matches the lock’s shape. And this is where Bitcoin mining becomes important.

Bitcoin mining

With Bitcoin mining, computers from all over the world collaborate to find the correct key for the lock through random trial and error, i.e., to solve the hash of a block. This process is very complicated and uses a lot of energy. But it makes sure that transactions are open.

Proof-of-work is the process by which multiple computer systems compete to find a number that gives a specific hash value (the key) at the same time. But in the end, only one computer gets the right answer.

Because it serves as the Bitcoin security system and pays the third party who encoded the block even with a tiny amount of bitcoins, many enormous businesses have turned Bitcoin mining into a billion-dollar industry.

Once a corresponding hash value is discovered, the block is added to the blockchain. As a result Bitcoin chain continues to grow.

This protects every transaction ever done with Bitcoins on the blockchain, which had a total amount of over 400 terabytes in July 2021. A Bitcoin mining group, for example, is appropriate for generating currencies.

Bitcoin is open-source and peer-to-peer

Because Bitcoin doesn’t need a central system or institution to run, it is always clear that the cryptocurrency is better than our traditional ways of paying. In actuality, there is not a singular megacorporation pulling all the threads behind the massive Bitcoin network.

The cryptocurrency is 100 percent open-source, which means that everyone has free access to the project data. Programmers, scientists, and experts from all over the world work together with passion for the digital currency, which leads to flat hierarchies, pragmatism, and unwavering conviction. Particularly, the aspect of horizontal hierarchies is highlighted by Bitcoin’s peer-to-peer (P2P) system. Every Bitcoin transaction occurs “from peer to peer” or “from equal to equal.”

In common language, the emphasis should not only be placed on the securely final transactions without the need for a mediator, but it should also be made clear that the Bitcoin peer-to-peer network depends on the users who are responsible for the overall structure.

Bitcoin’s advantages and disadvantages

Advantages

The advantages of Bitcoin are numerous. When searching for a response to the query “What is Bitcoin” the first thing that comes to mind is that Bitcoin transfers are completed peer-to-peer, without the use of a third party. Furthermore, because Bitcoin activities are always documented in the blockchain, they are open and cannot be influenced. They can be exchanged on a global scale and at any moment.

Bitcoin works like traditional money and you can use it to buy things. In the same way, because people buy and sell Bitcoins, the price of the cryptocurrency is less affected by inflation than the US dollar or the euro. The total amount of tokens available is maximum to 21 million currencies. In contrast to other currencies, Bitcoin has the greatest degree of recognition in society as the first, biggest, and most well-known altcoin.

- Decentralized payment system

- Transparency and security

- Boundlessness

- Same usage as money

- Missing Inflation

- Bitcoin is a market leader

Disadvantages

Bitcoin mining consumes a tremendous quantity of energy. As a result, many detractors point out additional drawbacks of Bitcoin aside from the loss of resources.

Because of division, few laws and changes in the economy are feasible. Governments all over the globe are presently working on answers to this problem. Furthermore, the BTC system only employs digital money, making it difficult for people who are unfamiliar with technology to use Bitcoins.

Something else sticks out in this context: to conduct Bitcoin operations, should be access to an internet link and a gadget capable of running the necessary software.

The technology itself can be attacked as well. Once a Bitcoin transaction has been verified, it cannot be undone. The deal may also take a long time because processing speeds differ greatly.

- No regulations

- Digitality

- Dependency

- Transaction speed

- Energy spending

What determines Bitcoin’s price?

Many people are put off engaging in Bitcoin because digital money, like Ethereum, has no inherent worth. It sounds to people like “a few lines of computer code.” Stefan Hofrichter, director of Allianz Global Investors’ “Global Economics & Strategy ” section, is also skeptical of the crypto colossus. He claims that “the inherent worth of Bitcoin is zero.” In this regard, Bitcoin and other cryptocurrencies are challenging to compare to assets such as gold because they lack real worth.

Yes, but what causes the elevated price of Bitcoin?

These are the characteristics of digital currency that determine the price and value of Bitcoin.

Scarcity – the limit of Bitcoins is 21 million tokens. Divisibility – a Bitcoin is divisible into 100,000,000 satoshis. Utility – future-proof advantages over fiat currencies, as mentioned earlier in the table. Longevity (a Bitcoin is many times more difficult to “destroy” than a dollar bill. Furthermore, it is society’s faith and confidence in these price-stabilizing characteristics that determine the price via the solely market-based supply and demand concept.

Where is the best place to buy Bitcoin?

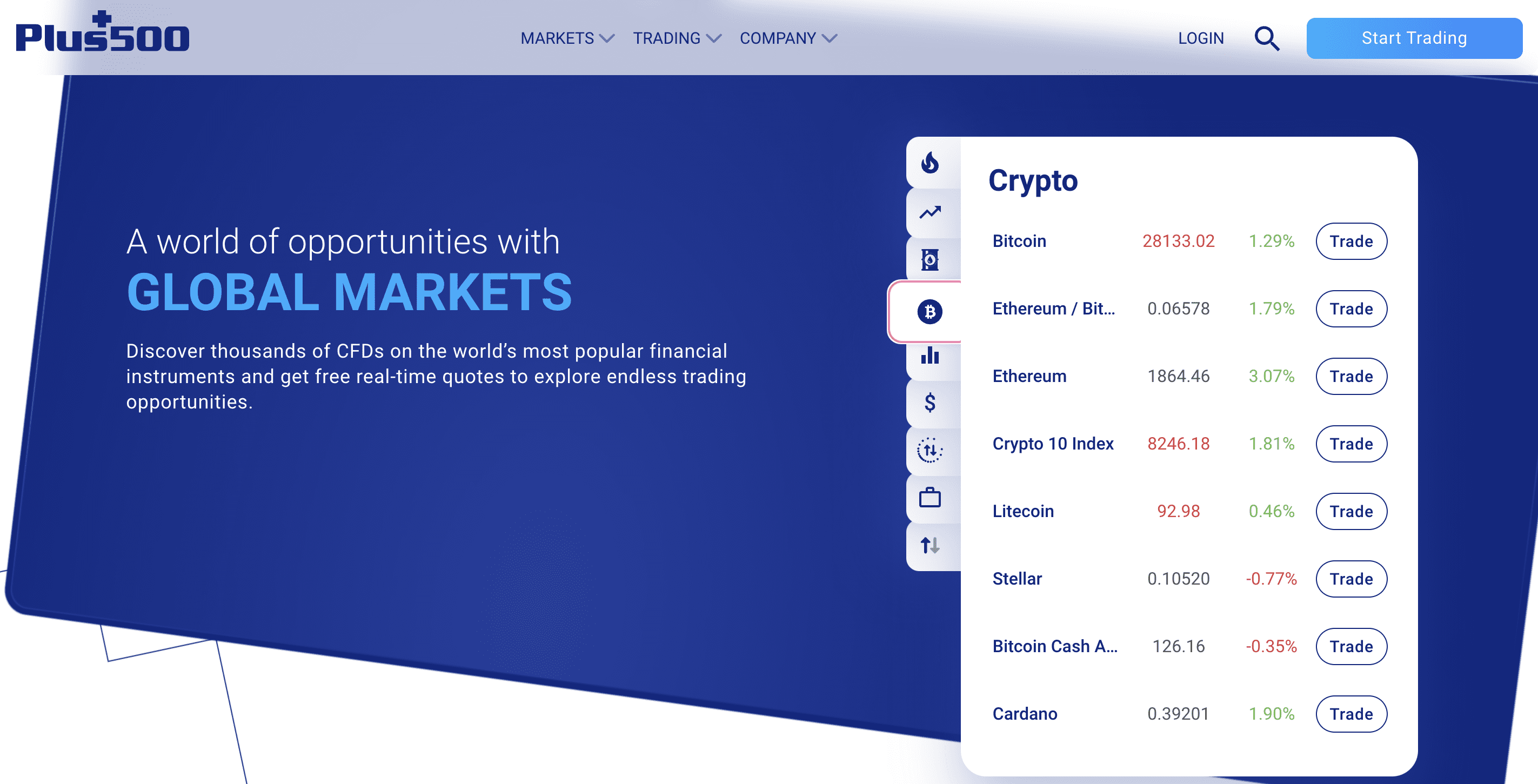

Plus500 is our recommendation for purchasing Bitcoin. There are numerous dealers from whom to purchase Bitcoins. It’s no surprise that many concerned parties lose track of all the benefits and drawbacks of various suppliers. As a result, we are glad to suggest Plus500, one of the biggest social trading networks and a globally famous dealer, because it has several advantages.

The platform was started in 2008 and has offices in Israel, Cyprus, the United Kingdom (UK), and Australia.

One of the main advantages of Plus500 is its user-friendly interface. It is easy for both new and experienced traders to navigate and execute trades. The platform has a lot of features, like customizable charts, technical analysis tools, and risk management tools. They help traders keep track of their positions and make good trading decisions.

Another advantage of Plus500 is the wide range of financial instruments available for trading. The platform offers over 2,000 instruments, which provides traders with a diverse range of opportunities to capitalize on market movements across different asset classes. Plus500 also offers competitive spreads with no commissions or hidden fees. That’s why it is an attractive option for traders looking for low-cost trading.

Plus500 is also popular for its sophisticated risk management tools, such as stop loss, delayed stop, and assured stop-loss orders, which aid dealers in limiting possible losses and managing risk. The platform also has protection against negative balances, which means that traders can never lose more than their account balance.

Overall, Plus500 is a safe and easy-to-use trading platform with a wide range of financial instruments, competitive prices, and advanced tools for managing risk. This makes it a popular choice for traders of all levels of experience.

- Recommended broker

Our recommendation:

Invest with Plus500

What does the future of Bitcoin look like? What is the potential of Bitcoin?

More and more people become interested in the crypto world, so it’s hard to say what the future holds for Bitcoin. But competition from other, often more developed digital currencies like Cardano or Ethereum is growing.

Due to the high amount of energy, it takes to process, Bitcoin is the least sustainable, especially when it comes to protecting the climate. This is why more and more people are skeptical about cryptocurrencies.

Still, Bitcoin is a digital alternative to traditional currencies, and its all-time high of $63,000 shows that it is gaining the trust of a large portion of the population. As a result, many experts believe Bitcoin will surpass the $100,000 mark in a few years or decades, making it extremely valuable in the future.

Conclusion: What is Bitcoin, and how important is it for the future?

Bitcoin is a digital currency that, thanks to blockchain technology and the proof-of-work algorithm, makes the work of third parties like banks seem unnecessary. Also, Bitcoin adds a whole new level of security and protection to the way people interact with each other.

You can use cryptocurrency just like regular money, but there are no bills or tokens. Because of this, it is completely digital and an important step in the process of digitization. And this is precisely where the cryptocurrency Bitcoin enters into play. Bitcoin, which was the first and is currently the biggest cryptocurrency, is helping to open the way toward the ultimate objective of depending only on a digital currency in the not-too-distant future. As a result, doing away with conventional currencies as well as real, material monetary values.

In the same vein, Bitcoin (BTC) should to have an even higher level of security, to be immune to inflation, and have a greater degree of decentralization than conventional currencies. Because of this, it’s natural to wonder how much Bitcoin will move toward this goal and if the complaint that it uses too much energy can one day change in a way that doesn’t hurt the environment. If you want to engage in Bitcoin right now, we recommend the offer provided by Plus500.