Both publications that focus on finance and experts in the field often call Ethereum “the cryptocurrency of the second generation.” Even though the project is frequently overlooked in the shadow of Bitcoin, there are very few people who are aware of the actual scale and complexity of the Ethereum blockchain. Not least because of this, we would like to use this article to describe the history and functionality of the world’s second-biggest crypto network.

What is Ethereum? Definition

First and foremost, the myth that Ethereum is a coin must be debunked. In reality, Ethereum refers to an international and open-source system that uses so-called smart contracts (described below) to handle, store, and perform a broad range of interactions between two parties.

Ether is the cryptocurrency that is used to pay for things on this network. Therefore, Ethereum can be understood as a type of management system in which the digital currency Ether functions as a trading indicator and, as a result, maintains an essential position within the overall construct.

- Creation – August 2015

- Current course (status: 06.04.2023): $1870.59

- All-time high: $4,356.99

- Founder: Vitalik Buterin, Gavin Wood

- Consensus algorithm: Proof of Stake

- Use-case: Infrastructure, Smart Contracts, DApps

- Currency in the ecosystem: ether

- Maximum number: unlimited

How exactly does Ethereum work?

The Ethereum white paper

Before launching their project, the founders of Ethereum, Vitalik Buterin and Gavin Wood, published a white paper. In this way, they followed in the footsteps of Satoshi Nakamoto, the inventor of Bitcoin. In this 36-page document from the end of 2013, which is mostly about the limits and restrictions of Bitcoin, the founders of ETH talk about their plan, the reason for making ETH, and the background of how it came to be. The paper was published in December 2013.

Ethereum mining

The Ethereum network completed its long-planned shift from the proof-of-work (“PoW”) consensus algorithm to the proof-of-stake (“PoS”) consensus algorithm on September 15, 2022, in an occurrence known as the merge.”

All reports say that the seven-year change went smoothly and was a turning point in the history of Bitcoin.

Commentators hailed the Merge as proof that a prominent blockchain, such as Ethereum—the largest blockchain in terms of the number of software projects developed on it and the second largest in terms of native token market capitalization—could run on the relatively energy-efficient PoS consensus algorithm rather than the far more energy-intensive PoW consensus algorithm, which Bitcoin continues to run.

Even though the merger may have saved money on energy and technology, the change in Ethereum’s system is already getting the attention of the courts. This warning looks at how the Merge and later events affected the SEC and other claimants’ ideas about whether Ether, Ethereum’s native currency, or staking programs related to Ether are stocks that fall under the agency’s jurisdiction.

Then Ethereum mining will no longer be possible.

Ethereum is open-source and peer-to-peer

Ethereum, like Bitcoin and other cryptocurrencies, is an open-source initiative. As Ethereum’s code is freely accessible, developers are encouraged to modify it, enhance it, and add new ideas.

Moreover, Ethereum is built on a peer-to-peer (P2P) network. As all ETH computers are connected equally, “equality” is the main focus here.

Hence, unlike in a server-client network, where computers access server data and serve two functions, all participants have the same roles and responsibilities. As a result, P2P technology is also required to keep the Ethereum project decentralized.

Our broker and exchange comparison enables you to purchase cryptocurrency with the lowest fees

Broker | Evaluation | Functions | Benefits | Spread | Leverage | Total Fees | Visit Provider |

|---|

4 | CFDs and forex, Stocks, ETFs, Crypto |

| Variable spread | 30:1 and other | 1% for buying or selling crypto |

4.8 | CFDs: Crypto, Indices, Forex, Commodities, Shares, Options, ETFs |

| Tight Spreads | 1:300 | No internal deposit fee |

| 4.4 | • FX

• Metals

• Indices

• Cryptocurrencies

• Stocks

• Energies

|

| Tight spreads starting from 0.0 | 1:400 | Depending on payment method |

4.2 | 49 global currency pairs, commodities, index CFDs, stock CFDs, ETFs, metals, commodities, energy |

| Tight Spreads | 1:1 – 30:1 | No fees |

4.0 | 1000+ financial instruments, including Foreign Exchange, Commodities, Indices, Share CFDs, Cryptos, ETFs, and Bonds |

| 1.27 | 1:500 | $3 per side for every 100,000 units |

3.9 | 70 crypto-pairs, 49 forex pairs (usdzar as well), 5 metals, 26 Indices, 130 stocks, 6 oil and gas, 6 agriculture assets |

| Spreads from 0.00 | 1:999 | 3% + inactivity fee |

Advantages and disadvantages of Ethereum

Pros

Ethereum, like many other cryptocurrencies, may make the “normal” arguments for decentralization, transparency, and security; however, we would like to highlight the following pros and cons compared to Bitcoin.

First, ETH is amazing because it can be used as a money and as a complicated, worldwide networked smart contract platform for any project.

So, the network may soon be crucial to many industries, not just Bitcoin.

Moreover, Ethereum is always developing and working on improvements such as Ethereum 2.0. Above all, the switch to the “Proof-of-Stake algorithm” promises to provide a considerable advantage over Bitcoin owing to large energy savings.

Moreover, ETH is likely the first, biggest, and hence most known platform of its type, which is why Ethereum is likely the “first port of call” for massive business initiatives. Because of these factors, Ethereum looks to many investors as a more sustainable and well-thought-out system than Bitcoin.

Cons

Even so, ETH is not as good as Bitcoin in a number of ways. For example, there are often news stories about security flaws, bugs, and hackers in the crypto network.

Theft and manipulation are much more common here than they are with Bitcoin. This is because the business as a whole is more complicated and has more moving parts.

Some commentators have also pointed the finger at Vitalik Buterin, who created Ethereum. Many people see him as the most decisive and influential voice on the trading platform and, as a result, as its “helmsman.” This doesn’t fit well with the goal of decentralization, which is to have as few people in charge as possible. Even though Ethereum 2.0 may be a good upgrade, it is risky to change the core of a project worth a billion dollars. These kinds of brave and bold moves might turn out to be a step in the wrong direction one day.

Ethereum is an intelligent trading network, yet its currency may be exchanged for any other cryptocurrency. Since this currency can be traded for any other cryptocurrency, it is not important to the project as a whole.

Another interesting thing about ethers is that there is no limit to how many of them can exist. Since there are so many tokens, they may be worthless, unlike Bitcoin.

What determines Ethereum’s price?

Unlike Bitcoin, Ethereum might be seen as having a value in and of itself because it hides a large ecosystem. This provides the platform with a level of flexibility that Bitcoin does not have.

No, Ethereum is more than simply a digital money system. It is a worldwide network that leverages blockchain technology to provide an infrastructure for projects of all types.

Ethereum offers software and Ether for banking, e-voting, real estate, insurance company bookkeeping, and healthcare history cards.

Ethereum users invest in complex and well-thought-out software that will be maintained and improved with Ethereum 2.0 and other projects.

Due to growing awareness of Ethereum’s complexity and brilliance, Ether’s price has skyrocketed.

How many Ethereums are there in total, and how many are left?

The total number of ethers is infinite. As a result, there is no top restriction of 21,000,000 or other amounts. The creators, Vitalik Buterin and Gavin Wood are taking a modest risk with this since, unlike Bitcoin, no artificial scarcity is used.

This, in turn, has no effect on the value. Yet, the performance of Ethereum shows that it can rank second among all cryptocurrencies globally, even in the absence of artificial shortages.

The digital currency has a market valuation of almost 300 billion euros, with around 117,000,000 ethers now in circulation.

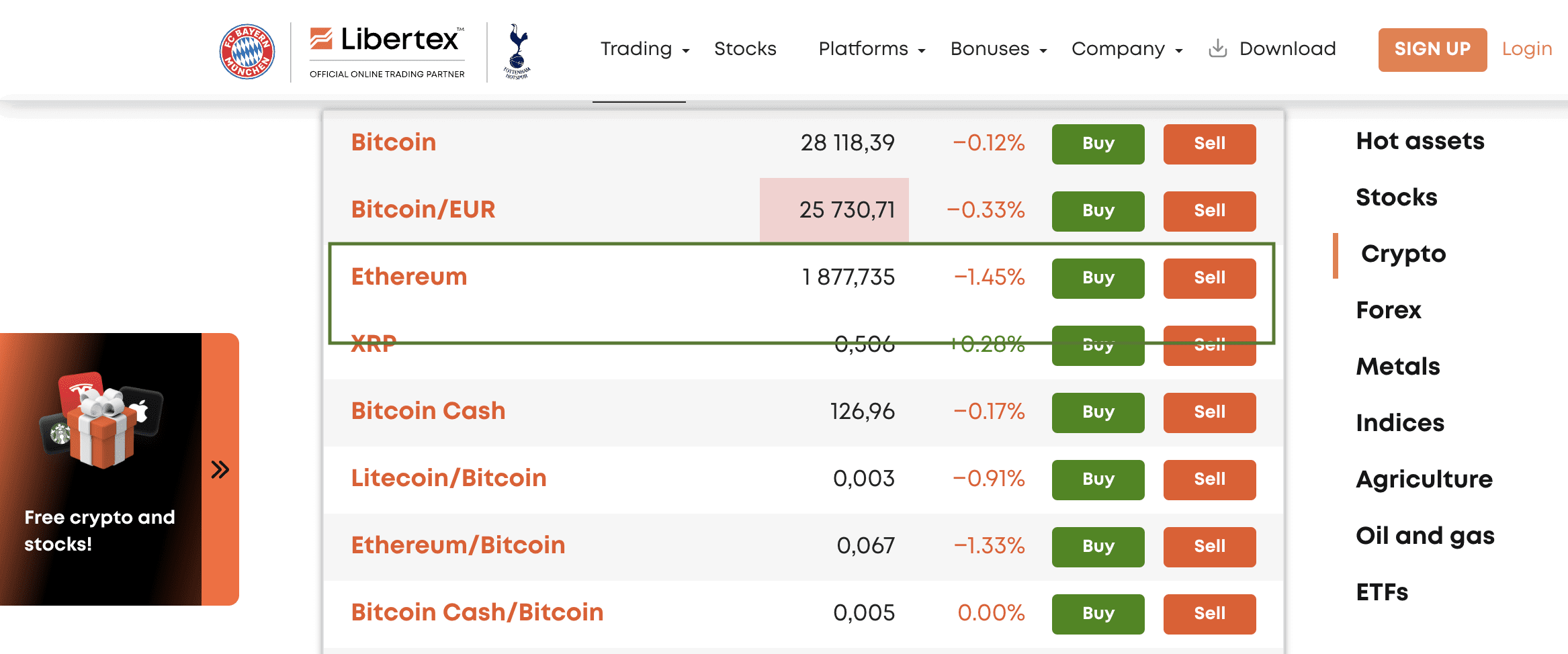

Where is the best place to buy Ethereum? We recommend Libertex

Libertex is an online trading platform that enables users to trade contracts for difference (CFDs) on a number of financial products, including Ethereum.

The platform’s user-friendly design, which makes it simple for both rookie and expert traders to explore and execute deals, is one of the benefits of trading Ethereum on Libertex.

Technical analysis, customizable charts, and risk management tools help traders watch their holdings and make informed trading choices. Libertex offers affordable Ethereum prices and low-cost Ethereum trading with tight spreads and no fees. Stop-loss and take-profit orders let Libertex traders limit losses and lock in profits.

The platform also protects traders from going into the red, so they never lose more than their account balance. In addition to these advantages, Libertex provides a variety of instructional tools and materials, including trading manuals, video lessons, and webinars, that may assist traders of all levels in improving their trading abilities and tactics.

Libertex is a reliable trading platform that is easy to use and has great tools for managing risk and learning. Because of this, it is a great option for traders who want to trade Ethereum and other financial assets.

- Recommended broker

Our recommendation:

Invest with Libertex

What is the potential of Ethereum?

Ethereum may continue to be significant in the future.

Consequently, the majority of experts believe that the share price will rise over the next few years. Also, when the long-awaited Ethereum 2.0 update comes out, some users expect the price to go up to around $10,000.

It remains to be seen whether this optimism will actually be rewarded. However, one thing is certain: Ethereum’s future appears encouraging.

Conclusion

In a few simple words: Ethereum is a digital network that provides a platform for a wide range of projects in areas like finance, politics, and health care. These projects use smart contracts, decentralized applications (DApps), and well-known blockchain technology. Ether is the digital payment method of choice in this ecosystem.

As was already said, Ethereum hopes that in the future it will be an important part of people’s everyday lives and become the world’s best way to make transactions. So, the price prediction for the token seems good for the next few years, especially in light of the Ethereum 2.0 update. A particularly elegant and secure way to invest in Ethereum is through the broker Libertex. The crypto platform’s versatility attracts individual buyers, multinational banks, insurance organizations, and corporations of all sizes.