Since 2014, there has been a highly unique internet currency: Monero. The unique feature: It is a privacy currency, with a primary emphasis on data protection and user anonymity. In this post, you will discover how and where to buy Monero (XMR). You’ll also learn about exchanges and trading platforms, as well as if you can buy XMR coins using PayPal and other payment methods.

How to Buy Monero Quickly and Safely?

If you want to take advantage of the benefits of a “Privacy Coin” and value anonymity, Monero Coins are the correct solution for you. This is a quick-start guide for really “impatient” or “completely educated” people. For extensive buying instructions, please go here.

Go to the Plus500 main page. Enter your e-mail or cell phone number, agree to the terms and conditions, click the confirmation button, and answer the personal verification questions. And then go to step 2.

On the left side of your dashboard, click “Funds,” then choose the preferred method and amount, and confirm. PayPal, credit card, Sofort Banking, Skrill, Neteller, and bank transfer are all options.

Search for XMR in the search box and then choose XMR from the results.

Input the desired amount in the “Purchase XMR” column and finish the transaction with “Sell XMR.”

In a nutshell, these are the essentials:

- Monero, which was founded in 2014, is not one of the cryptocurrency’s “greenies.” Monroe has received several and significant upgrades since its first release.

- Monero places a high value on its investors’ privacy and anonymity.

- Monero is built on the CryptoNote protocol, which, unlike many other related services, is not based on a code branch from Bitcoin.

- RandomX is a proof-of-work-optimized algorithm that, like most of its ilk, is meant to protect its investors against denial-of-service assaults or spam.

- Monero is constantly concerned with keeping mines appealing and secure for investors. Monroe’s method is based on an infinite distribution. There will be two major distributions. The first will be finished by May 2022 and will have distributed around 18.132 million coins, followed by the second major distribution with 0.6 XMR per 2-minute block.

Where can I get inexpensive Monero? Our broker and exchange comparison enables you to purchase Monero with cheap fees

Broker | Evaluation | Functions | Benefits | Spread | Leverage | Total Fees | Visit Provider |

|---|

4.8 | CFDs: Crypto, Indices, Forex, Commodities, Shares, Options, ETFs |

| Tight Spreads | 1:300 | No internal deposit fee |

| 4.4 | • FX

• Metals

• Indices

• Cryptocurrencies

• Stocks

• Energies

|

| Tight spreads starting from 0.0 | 1:400 | Depending on payment method |

4.2 | 49 global currency pairs, commodities, index CFDs, stock CFDs, ETFs, metals, commodities, energy |

| Tight Spreads | 1:1 – 30:1 | No fees |

4.0 | 1000+ financial instruments, including Foreign Exchange, Commodities, Indices, Share CFDs, Cryptos, ETFs, and Bonds |

| 1.27 | 1:500 | $3 per side for every 100,000 units |

3.9 | 70 crypto-pairs, 49 forex pairs (usdzar as well), 5 metals, 26 Indices, 130 stocks, 6 oil and gas, 6 agriculture assets |

| Spreads from 0.00 | 1:999 | 3% + inactivity fee |

What exactly are Monero CFDs?

We now recommend you to invest in Monero with Plus500, a broker known mostly for its strong CFD offerings.

So what exactly is a Monero CFD? If you are absolutely new and unskilled in this field, you should read our guide to CFD trading.

Yet, once again, we’d want to provide a high-level explanation of how trading works in this manner.

CFDs are a kind of derivative. This trading good refers to pure financial instruments that utilize the price of certain assets as the underlying.

Therefore, you may wager on growing or decreasing Monero rates without needing to purchase the coin. This, of course, minimizes the amount of money to be employed, but it also increases the chance of loss.

In effect, the return is the difference between the opening and closing prices of the position.

On the other hand, such CFDs are best suited for day traders with prior trading expertise. The commodity may be risky, especially since keeping holdings might result in fees, so you should know what you’re doing here. Beginners should thus use a trading trial account before trading with real money.

Is there a difference between buying Monero with euros in Germany and Switzerland and Austria?

Being a decentralized commodity, it shouldn’t matter where you operate from. As a result, you may simply purchase Monero with euros using the broker Plus500. This is valid in Germany, Austria, and Switzerland. So let us go a bit further into the subject.

So if you take it seriously, you must also address tax difficulties. Since three distinct agencies are in charge, it is critical to double-check what information must be submitted. This is when a tax attorney might come in handy.

Sadly, there is no universal solution for Germany, Switzerland, or Austria, therefore purchasing Monero with euros is not possible.

Should you buy Monero? Our reasons for purchasing!

No other privacy currency has as many supporters as Monero. Monero has become one of the most well-established cryptocurrencies on the market because of its complex system of ring signatures and stealth addresses, as proven by its high rating on CMC: according to Marketcap, Monero was ranked 12th in December 2018. CMC has the most recent rating.

If the crypto exchanges encounter greater excitement, it is nearly clear that Monero will profit more than other privacy currencies such as Verge or Zcash. The popularity of Monero as a payment method, particularly on the dark web and for private financial transactions, suggests that the cryptocurrency will be around for a long time.

Apart from the usual volatility of the cryptocurrency industry, there is nothing that argues against investing in Monero, in our opinion. With the very low costs in December 2018 compared to the previous year, this may be an excellent opportunity to buy in Monero. But it is possible that prices may fall more and that no new buzz will emerge.

Buy Monero as a CFD or as a genuine cryptocurrency?

Our guide to investing in Monero should make it apparent that there are two approaches to investing. As a result, you may either utilize CFD papers or purchase genuine cryptocurrencies. But who is it appropriate for?

Overall, we strongly advocate CFD trading, especially because you can do it with the licensed broker Plus500.

As a result, one is moving on controlled terrain and in familiar surroundings. A wallet isn’t even required, and dealing with digital currency doesn’t require a lot of technical understanding.

- Recommended broker

Our recommendation:

Invest with Plus500

Monero Trading: Should you retain Monero for the long term or trade it?

The topic of whether long-term or short-term techniques are preferable in Monero trading emerges. This is also about the commodity chosen.

The subject has previously been discussed many times on this website, but we’d like to bring it up again for completeness.

CFD positions are especially beneficial for short-term investing. Although longer agreements are feasible, they are not typically suggested due to overnight expenses.

Hence, if you want to preserve the cryptocurrency in your portfolio for the long run, you need to establish a Monero wallet and store the token there.

Is it worth to buy Monero?

Whether a Monero investment makes sense in the end is determined by one’s personal expectations and investing objectives on the one hand and the return on the other.

It is thus critical to first clarify your own aims before engaging in a prospective deal. Maybe you are more interested in the technology and would prefer to use the coins one day.

The coins might then still be obtained at a low cost. But, such changes are still in the future; therefore, let’s look at some other assets from the crypto industry that are similarly appealing.

Purchase bitcoin right now

You don’t have to bring up the huge Bitcoin anymore. Being the initial cryptocurrency, the BTC token continues to have the highest market value and is the primary driving force behind the whole sector.

Purchase Cardano right now

Cardano is like the cryptocurrency of the moment. Cardano’s Ada Coin has long been overlooked by the larger digital currencies, but it is now a recognized rival. Here is where blockchain-based smart contracts become feasible.

Purchase IOTA right now

IOTA is a prominent cryptocurrency from Germany, namely Berlin. Instead of the blockchain, a so-called tangle emerges, which has already proven to be extremely popular in business. New projects and collaborations are revealed on a regular basis, giving reason to hope for the best.

Purchase Ripple XRP right now

You like something a bit more daring? Then Ripple could be right for you. The corporation behind the XRP coin is presently embroiled in historic legal battles with the US Securities and Exchange Commission. If everything goes as planned, substantial price increases should be in store.

This is the time to invest in classic equities

States have pumped a lot of money into all markets as a result of the Corona crisis. Inflation is a problem, and financial history has proven that equities, in particular, have a degree of value stability. In this regard, cryptocurrencies have a slightly more stable alternative.

Benefits and drawbacks

There are several reasons in favor of investing in Monero. But we must consider the other viewpoint and the counterarguments to an investment.

First and foremost, we are working with a highly skilled development staff. This is critical for the technology, and not every cryptocurrency has this level of expertise.

As a so-called privacy currency, the emphasis is on data security and user anonymity. So you’ve long ago distinguished yourself from other tokens that simply provide seeming anonymity.

Overall, Monero has already been on the market for a while, which lessens the risk of the investment significantly.

- Excellent development team

- The most well-known privacy coin on the market

- Good identity protection for both sender and recipient

- Overall, a well-known cryptocurrency

- Investment risk in general

Monero (XMR) is a decentralized, blockchain-based cryptocurrency that focuses on data security and user anonymity as a privacy coin. Here is where Monero differs dramatically from Bitcoin dramatically. Additional unique features of the altcoin Monero include the self-developed proof-of-work algorithm CryptoNight, notably high scalability, and decentralized mining.

Unlike Bitcoin, Monero’s storage affinity means that specifically designed mining equipment has no advantage over normal household computers. As a result, Monero is also acceptable for mining by private individuals. The term “Monero” is derived from the planned language Esperanto and means “coin” or “money.”

According to Monero, approximately 240 engineers are already working on the project, with roughly 30 of them serving as the “core team.” It was founded in 2014 and has acquired a loyal following due to its dependability and effectiveness. Monero presently has almost 1.4 billion euros invested in it. It’s encryption is regarded as almost unbreakable due to the technology utilized, and transactions are therefore exceptionally secret.

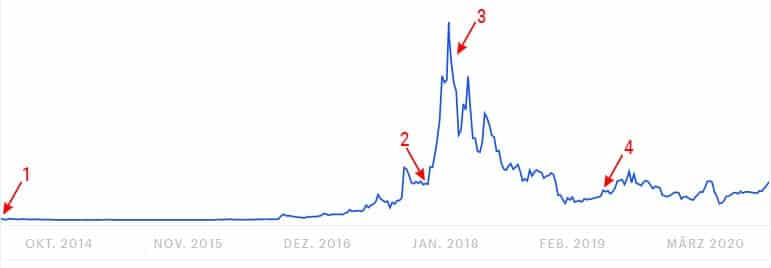

History of Monero: Significant Moments

The bitcoin market has had its share of ups and downs. We provide the most significant events in Monero’s history.

- The first Monero coins were released in April 2014 for roughly 16 euros.

- Monero is growing and leaping from €90 to an astonishing €400 as a result of the hard fork of the new coin MoneroV and the generally booming crypto market.

- Monero, like other cryptocurrencies, suffers from the Bitcoin decline and falls below €80.

- Monero’s popularity has grown as a payment option for popular games such as Fortnite, and it has already peaked at €100.

Can I buy Monero with PayPal?

Popularity of using PayPal for investing comes up again and again.

The quick answer is yes, you can buy Monero with it! In any case, we propose Plus500, a CFD broker that accepts PayPal payments. Thus, you’re confined to derivatives, which may be quite useful for Monero trading.

The scenario becomes more complicated when using actual tokens. Despite the fact that the payment service provider has now incorporated cryptocurrencies, the corporation refers to the most popular digital currencies, such as Bitcoin or Ethereum.

Hence, if you want to purchase Monero using PayPal, you may do so if your primary goal is trading. If not, you must use other payment options.

Is it feasible to Buy Monero while being anonymous?

Monero promotes its coin as having exceptional anonymity, which is supposed to be substantially greater than that of other digital currencies. As a result, the currency is classified as a privacy coin.

When you execute a transaction in the network, it is difficult for other parties to understand who transferred how much to whom. As a result, it is totally feasible to purchase Monero anonymously. Yet, the issue of where to do this emerges.

Even bigger stock exchanges that do not have an EU license and are not subject to certain laws are increasingly requiring their customers to give certain data.

If you then purchase a Monero coin, the transaction is at least visible to the platform’s operator. Hence, if you venture a bit farther online in search of alternative methods to purchase Monero anonymously, you are walking on incredibly shaky ground.

We advise avoiding such investments since fraud is common in this area. In this regard, it is preferable to provide everyone with your data as part of a verification process and then invest securely and seriously via Plus500.

Is it feasible to acquire Monero without having to verify your identity?

Nonetheless, verification has made its way into the bitcoin industry. Coinbase, Binance, and other cryptocurrency exchanges all demand some type of account or identification verification.

This is also meant to keep international money laundering at bay. Thus, if you try to purchase Monero without verification, you can run into my issue. In the next paragraph, we will explain why this is the case.

Is it possible to purchase Monero without first registering?

We don’t want to say it too many times. Anyone who inquires for verification often implies full registration.

What if you could locate an offer online and obtain Monero coins without entering any more information or establishing an account?

But the truth is much different. Since security is paramount, the different platform operators need registration.

Purchasing Monero without registering is theoretically only feasible if you have XMR credit and can contact friends or acquaintances. You might then purchase their coins from them.

Can you Buy Monero at a store?

You may also purchase Monero offline if you utilize the approach outlined above. Yet, it is unlikely that you would come across somebody who has cryptocurrency in their portfolio. If you locate someone who possesses Monero and wants to sell their tokens, you may purchase XMR offline.

This is also the only method we can strongly endorse. There are no ATMs for Monero, like there are for Bitcoin.

Whenever you come across an offer on the Internet, whether on the Dark Web or in classified advertisements, you should ignore it as quickly as possible. Crypto fraud is all too common, and it is even harder to identify with Monero since the fraudsters may remain quite anonymous.

Monero alternatives include trading other cryptocurrencies or equities

It is often debated in numerous places how to exchange Monero shares. Such eager merchants, however, are a bit ahead of their time. So far, Monero has had to be satisfied with tokens. But that doesn’t mean you won’t get the chance again in the future. It is important to read the crypto news on a frequent basis to ensure that you are constantly up to speed.

Option 1: Monero stocks

One possibility is to invest today in such firms that have begun working with Monero. Tencent or Epic Share are two examples.

- Epic Share: Via a cooperation with Epic Games Studio, it is able to purchase games such as Fortnite using Monero. As a result, these two stocks are linked.

- Tencent stake: Tencent has a stake in a number of firms that produce games that accept Monero payments. It may be predicted that the success of the Tencent share will continue to benefit Monero and help it achieve wider adoption.

Option 2: Cryptocurrency investment opportunities

Nevertheless, there are many more cryptocurrencies that have significant potential:

- Purchase Bitcoin: Many consider Bitcoin to be the “digital gold” and one of the most stable cryptocurrencies.

- Purchase Ripple: With the backing of several banks, Ripple is a viable alternative to Monero.

- Buy Ethereum: Ethereum is a smart contract solution that takes a similar approach to Monero.

Option 3: Cryptocurrency stocks

Crypto stocks are another option: So far, chip manufacturers, mining companies, and even the Bitcoin Group have all seen significant gains.

- Bitcoin stocks: If you believe Bitcoin will outperform Monero, Bitcoin stocks are a viable option.

- NVIDIA stocks: NVIDIA manufactures important graphics chips, particularly for mining; if the crypto boom continues, NVIDIA is a sure bet.

How to Sell Monero: Our Plus500 Guide

We discussed the topic of purchasing Monero and provided you with instructions at the beginning of this page.

Let’s go over how to sell Monero once more.

Step 1: Is to register at Plus500

If you have not yet registered, the first step is to do so. Then, using your user name (email) and password, you log in to the trading overview.

Step 2: Go to the trading window

We must now proceed to the cryptocurrency. It’s simple to do by typing “Monero” or “XMR” into the appropriate search box.

Of course, you can simply scroll through the offer here by using the general overview of the crypto markets. There are other digital currencies.

Step 3: Close your Monero short or buy position

We now have two options for actively selling Monero after dealing with CFDs. The first option does not even necessitate any prior XMR investment. So-called short positions are mentioned. Even if you do not own the assets, this is possible with derivatives. So one hopes for a price drop in order to profit from it.

Another possibility is that you have already opened a buying position. This buy position is closed in order to get profits (or minimize losses). The account is then debited for the difference between the opening and closing prices.

- Recommended broker

Our recommendation:

Invest with Plus500

Conclusion: Should You Buy Monero?

Monero is a new cryptocurrency. After extensive research, we determined that CFDs from the broker Plus500 are the best way to invest.

This is especially appropriate for short-term positions, some of which offer high returns. However, it is always critical to maintain a well-balanced portfolio and a healthy risk distribution.

The privacy coin works well in a multi-asset portfolio that includes both cryptocurrencies and other assets, such as stocks. Plus500 provides appealing access to all of these goods.