In this comprehensive eToro review for 2024, we delve into the platform’s offerings, including crypto CFDs, its mobile app, fee structures, and more. Discover the latest insights and best eToro experiences to help you make informed trading decisions.

Renowned for its ubiquitous YouTube advertisements and the concept of social trading, eToro stands out as a prominent trading platform. Its mission is to streamline trading processes, ensuring simplicity and efficiency. Offering a wide array of assets, eToro enables users to trade stocks alongside CFDs for leading cryptocurrencies such as Bitcoin and Ethereum.

But what about regulatory compliance? Is eToro a trustworthy platform? How does it fare in performance tests? Delving into these inquiries and more, we provide a comprehensive examination in this article.

What are the merits of choosing this provider? What about the fee structure? And how does the mobile app stack up? We’ll explore these aspects shortly. Cryptosoho has diligently tackled these questions and consolidated eToro’s 2024 experiences. Here, prospective traders can glean insights into popular cryptocurrencies, stocks, forex, and CFD brokers.

- Recommended broker

Our recommendation:

Invest with eToro

eToro Review: Pros and Cons

In this eToro review, we highlight the platform’s strengths and weaknesses to provide you with a comprehensive overview before diving into trading.

Advantages of eToro

- User-Friendly Platform: eToro stands out with its intuitive interface and swift registration process.

- Social Trading: The option for copy trading is highly praised, making it accessible for both new and experienced investors.

- Wide Range of Assets: With stocks, forex, digital currencies, and commodities on offer, eToro caters to diverse investment preferences.

- CFD Cryptocurrencies: eToro boasts over 160 CFD cryptocurrencies, making it a top choice among brokers.

- Diversification Opportunities: The eToro app provides various investment options, including the ability to follow and replicate other users’ trades.

- Demo Account: New traders can learn the ropes through the demo version and the platform’s informative blog.

- User-Friendly Interface: eToro’s platform offers essential features like watchlists and portfolio overviews for seamless investment management.

- Copytrading Innovation: Copytrading allows users to emulate the strategies of successful traders, simplifying the investment process.

- Low Fees for Stocks: eToro’s commission-free stock trading makes it an economical choice for stock market investors.

Disadvantages of eToro

- Limited Live Support: Customer service primarily relies on FAQs and email support, lacking real-time assistance.

- Deposit Protection Limit: European regulations limit deposit protection to €20,000.

- Inactivity Fee: Users face a $10 monthly deduction for inactivity exceeding 12 months.

- Payment Processing Delays: While eToro offers multiple payment options, users may encounter delays in processing, along with a $5 withdrawal fee.

- Feed Issues: The platform’s feed feature may suffer from spam, hindering access to genuine information.

- Trading Suspension: eToro may suspend trading in extreme market conditions, potentially causing missed opportunities.

- Sign-Up Challenges: Some users experience difficulties with the verification process, particularly during periods of high market volatility.

By considering both the advantages and drawbacks of eToro, you can make informed decisions when navigating the world of online trading.

- Free stock and ETF trading

- Seamless account opening

- Social trading

- $5 withdrawal fee

- Only USD as base currency

- Customer support should be improved

What is eToro?

eToro, founded in 2007 in Tel Aviv, Israel, is a renowned multi-asset platform and a global leader in social trading. With over 20 million customers worldwide and registered offices in the UK, Cyprus, Israel, and China, eToro aims to democratize access to global markets, enabling everyone to trade and invest transparently.

As a social investment platform, eToro allows retail investors to seamlessly view, follow, and replicate the trades of top traders on the network. Co-founded by brothers Assia and David Ring, eToro introduced the OpenBook social investment platform and Copy Trader feature in 2010. This innovative feature paved the way for the development of its social news feed and Popular Investor program later that year.

In 2011, eToro launched its first Android app, providing investors with the convenience of trading stocks via mobile devices. Today, eToro operates in over 140 countries and offers access to a diverse range of assets, including stocks, commodities, indices, ETFs, and crypto CFDs.

eToro Review: CFD Crypto Trading

Since its founding by Yoni Assia and Ronen Assia, eToro has developed into a reputable exchange. With the addition of Webtrader in 2009 and mobile apps in 2011, eToro expanded its reach. In 2013, it introduced stocks from prominent companies. Notably, in 2017, eToro extended its offerings to include CFD cryptocurrencies like Bitcoin, Ethereum, and Litecoin.

Corporate Values: eToro prioritizes simplicity, innovation, entertainment, safety, and quality in its operations.

Tradeable CFD Cryptocurrencies: Since 2017, eToro has continually expanded its CFD cryptocurrency offerings. Currently, the platform features over 120 different digital currencies, providing users with a diverse range of tradable currency pairs.

eToro Review: Buying Shares

Investing in stocks through eToro offers a unique advantage compared to traditional stock portfolios: zero commission trading. With eToro, you can buy and sell stocks without incurring any commission fees, eliminating the need to pay high fees for acquiring company shares.

Key Points:

- Zero Commission Trading: eToro does not charge any commission fees for opening and closing positions, unlike conventional brokers.

- Costs for Short Positions and Leverage: While commission fees are waived, costs may apply for short positions and leverage.

- Investment Options: eToro provides two options for investing in stocks: bringing real trading values into the eToro depot or investing in derivatives via CFD positions.

- Risk Considerations: Trading with leverage involves high risks and should be approached with caution.

- Global Market Access: eToro offers access to around 2,000 stocks from 17 stock exchanges worldwide, allowing investors to diversify their portfolios across various markets.

- Minimum Trade Requirement: A minimum amount of $10 USD is required per trade, providing accessibility to investors of all levels.

Get Your eToro Account in 3 Easy Steps

Opening an eToro account is a straightforward process that can be completed in just a few steps. Here’s how:

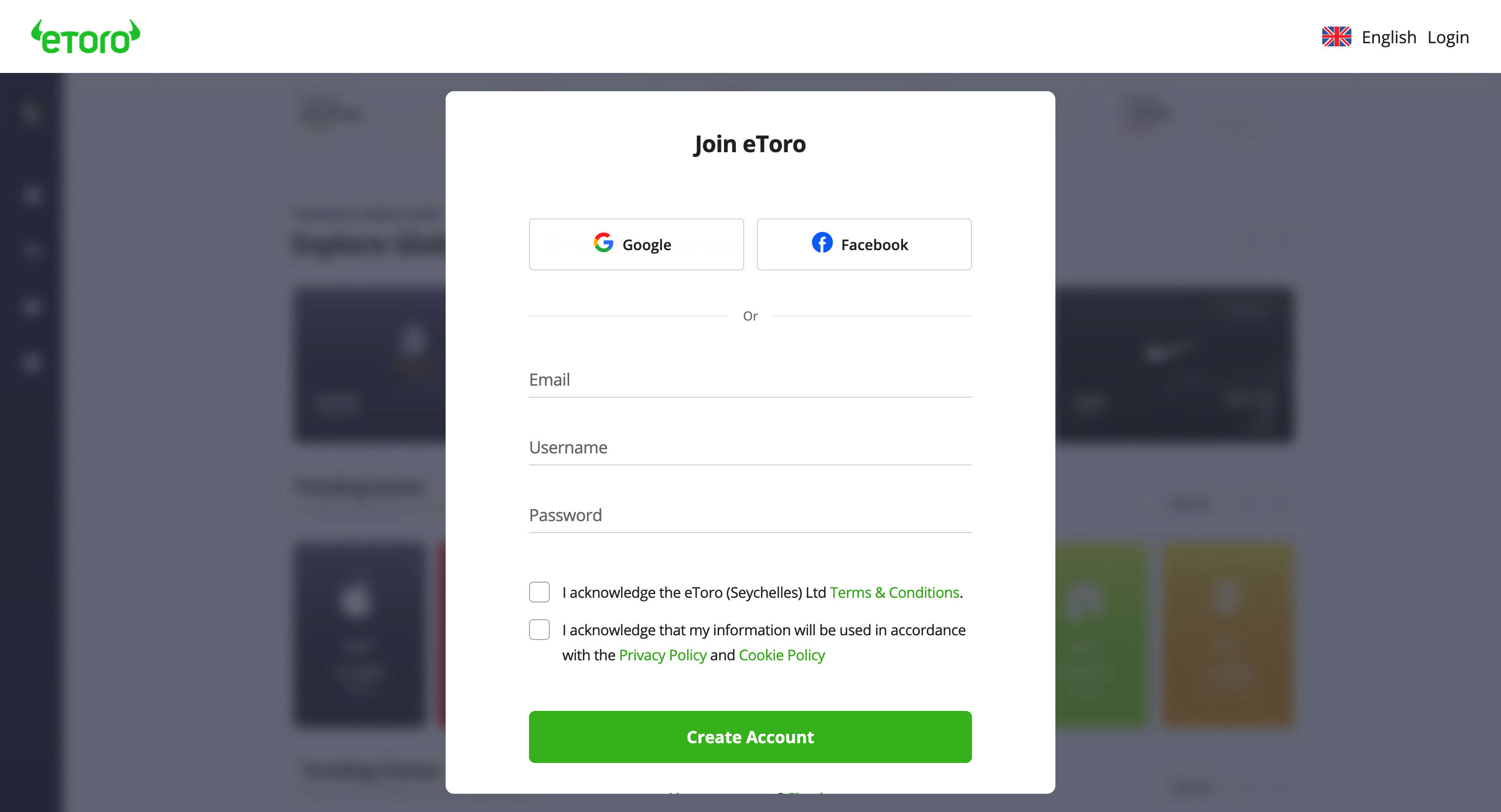

Step 1: eToro Login & Registration

- Sign up for an eToro account either by creating a new user account or by registering via Facebook or Google for a simplified process.

- Provide basic personal information such as your first name, last name, and email address, and verify your identity via a link sent to your inbox.

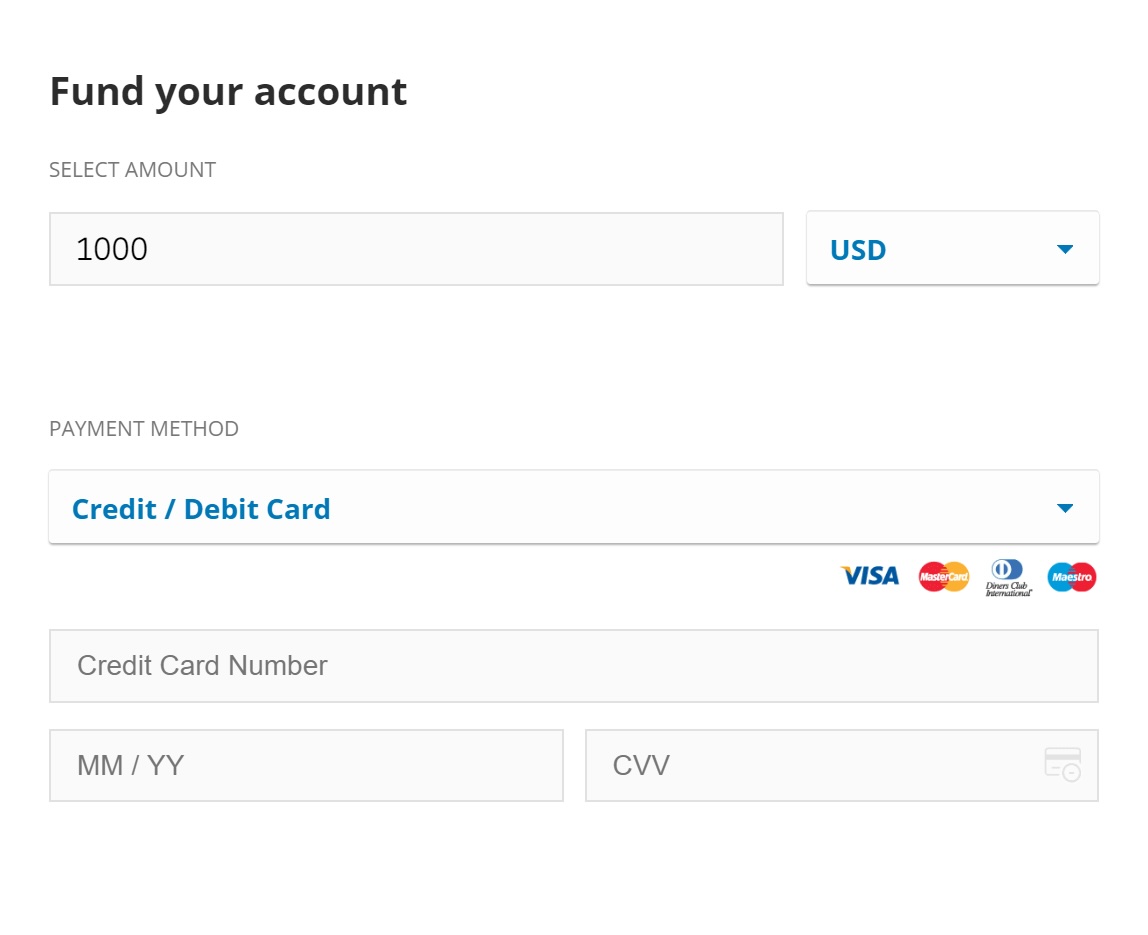

Step 2: The Deposit

- Once your account is set up and your identity is confirmed, deposit funds into your account to start trading.

- Choose from a variety of deposit options, including PayPal, to fund your account.

- Note the minimum deposit requirement: $500 for bank transfers and $100 for other options.

Step 3: Choose an Investment

- After funds are deposited, select your desired investment type and asset.

- Choose from a wide range of options, including 250+ ETFs, 2000+ stocks & leveraged CFDs, 70+ CFD cryptocurrencies, and more.

- Specify the quantity, review fees, and confirm the transaction.

With your eToro account set up and funded, you’re ready to start trading. Keep in mind that past performance is not indicative of future results, and you can buy and sell assets at any time via the eToro app or desktop platform.

Minimum Deposit at eToro: Explained

Understanding the minimum deposit requirements at eToro involves considering different scenarios, including the initial deposit, subsequent deposits, and specific requirements for different regions and account types.

General Overview:

- For the initial deposit upon opening an account, eToro requires a minimum of $100.

- Subsequent deposits can be as low as $50.

- Bank transfers have a higher minimum deposit requirement of $500.

- Residents of Australia must deposit at least €50 for their first deposit.

- Residents of Israel and corporate accounts have higher minimum deposit requirements of $10,000.

Payment Methods and Regional Variations:

- Transactions via credit cards (Visa, Mastercard, Maestro), PayPal, Neteller, and Skrill have the same minimum deposit requirements as the general guidelines.

- Bank transfers, however, require a minimum deposit of €500 when initiated from a German bank account.

- Specific values may vary for customers in different regions. For example, residents of Australia must adhere to the minimum deposit requirement of €50.

- Residents of Israel and corporate account holders face the highest minimum deposit requirement of $10,000.

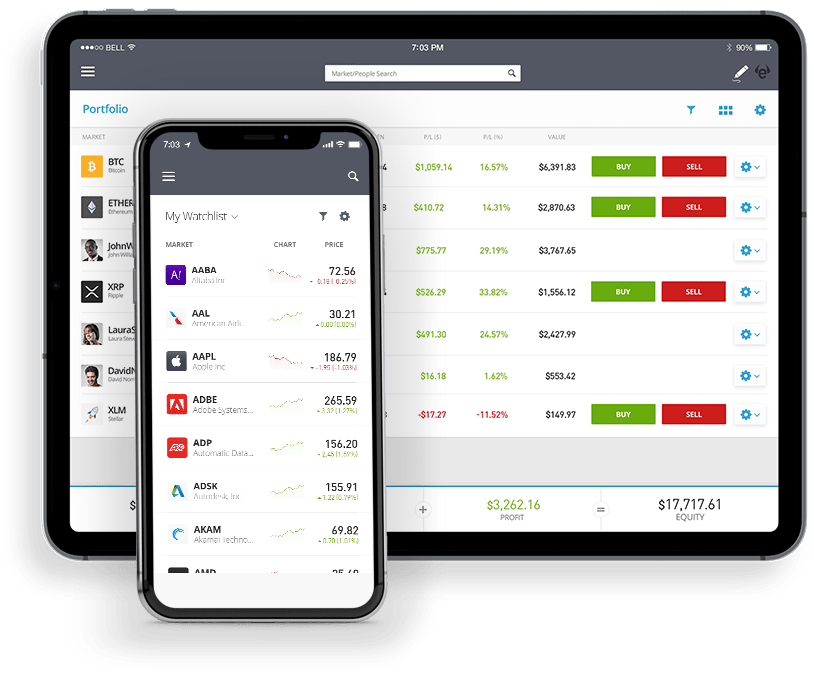

The eToro Mobile App: Trading on the Go

The eToro app, available for both Apple and Android smartphones since April 2011, revolutionized trading by enabling investors to conduct transactions anytime, anywhere.

Key Features:

- Accessibility: Compatible with almost every mobile device, offering seamless trading experiences.

- Browser Access: Alternatively, users can access the eToro website via smartphone browsers without the need for app installation.

- Flexibility: Trade CFDs in cryptocurrencies and other assets with full flexibility, providing on-the-go trading opportunities.

- Functionality: Boasts nearly all features of the desktop version, including currency, stock, and CFD trading.

- Live Prices: Real-time prices for CFDs of tradable cryptocurrencies are readily available within the app.

- Transaction History: Easily track all purchases and sales through the mobile interface.

- Popularity: With over a million downloads, the app has gained widespread adoption among traders.

- Compact Size: At 69 MB, it’s compact enough not to burden device storage.

User Experience:

- Support: eToro promptly addresses user reviews and feedback, ensuring a responsive support experience.

- Security: Regular updates ensure the app’s security, maintaining a safe trading environment for users.

eToro Review: License and Security

Security is a top priority at eToro, ensuring investors’ accounts and funds are safeguarded. Funds are held in Tier 1 European banks, known for their high core capital and risk resilience. The website employs SSL encryption to mitigate external threats.

The Cyprus Securities Exchange Commission (CySEC) has granted eToro (Europe) Ltd. license number 109/10, ensuring compliance with regulatory requirements. The broker’s license originates from Cyprus, an EU country, requiring adherence to European regulations. Deposit protection is provided up to $20,000.

It’s important to note that while eToro is regulated, CFD cryptocurrencies remain unregulated, exposing traders to potential risks without international protection.

Top eToro Alternatives: Brokers

eToro stands out as a pioneer in social and copy trading, offering a wide range of assets, 24/7 support, and favorable conditions. Its modern and intuitive platform makes it ideal for beginners entering the finance world.

While there are other reputable brokers available, eToro remains our top pick for virtually every asset class. Nevertheless, let’s explore some of the most notable eToro alternatives. It’s worth noting that, in our view, none of these providers truly match up to the industry leader.

Broker | Evaluation | Functions | Benefits | Spread | Leverage | Total Fees | Visit Provider |

|---|

4 | CFDs and forex, Stocks, ETFs, Crypto |

| Variable spread | 30:1 and other | 1% for buying or selling crypto |

4.8 | CFDs: Crypto, Indices, Forex, Commodities, Shares, Options, ETFs |

| Tight Spreads | 1:300 | No internal deposit fee |

| 4.4 | • FX

• Metals

• Indices

• Cryptocurrencies

• Stocks

• Energies

|

| Tight spreads starting from 0.0 | 1:400 | Depending on payment method |

4.2 | 49 global currency pairs, commodities, index CFDs, stock CFDs, ETFs, metals, commodities, energy |

| Tight Spreads | 1:1 – 30:1 | No fees |

4.0 | 1000+ financial instruments, including Foreign Exchange, Commodities, Indices, Share CFDs, Cryptos, ETFs, and Bonds |

| 1.27 | 1:500 | $3 per side for every 100,000 units |

3.9 | 70 crypto-pairs, 49 forex pairs (usdzar as well), 5 metals, 26 Indices, 130 stocks, 6 oil and gas, 6 agriculture assets |

| Spreads from 0.00 | 1:999 | 3% + inactivity fee |

Is eToro Legit or a Scam?

The question of whether eToro is legitimate or a scam is frequently asked. After conducting a thorough evaluation of online reviews and intensive testing, it’s clear: eToro is not a scam.

However, it’s essential to beware of imitators such as “etorro” or “e Toro.” eToro consistently highlights the risks involved in trading and transparently explains the associated fees.

With over nine million users, eToro is a trusted platform and a licensed CFD and Forex broker. The eToro app has been downloaded over a million times and boasts a rating of 4.0 out of 5 stars.

The Cyprus Securities and Exchange Commission (CySEC), which holds a cross-border EU license to operate across all member states of the European Economic Area, regulates eToro. Similar regulations are in place in the United Kingdom, overseen by the Financial Conduct Authority (FCA), and in Australia, regulated by the Australia Securities and Investments Commission (ASIC).

eToro Review: Our Conclusion

The eToro experience highlights its exceptional diversity in trading products. From CFD cryptocurrencies to stocks, foreign exchange, and futures, a wide array of investment options across different markets is available for portfolio diversification.

Both the website and the app boast modern designs and user-friendly interfaces, offered in 20 languages for global accessibility. Customer service is responsive and helpful, contributing to overall satisfaction.

eToro is widely respected and has a global presence in over 140 countries, positioning itself as one of the premier choices in online trading. The FCA and CySEC regulate eToro, ensuring the security of investors’ funds. Its platform offers a broad range of assets, including stocks, ETFs, and CFD cryptocurrencies.

With innovative features like social trading and copy trading, eToro is revolutionizing the trading landscape, making it more accessible, particularly for new traders. In summary, eToro stands out as one of the best and easiest-to-use platforms among exchanges and Forex brokers, living up to its esteemed reputation.

- Recommended broker

Our recommendation:

Invest with eToro

Disclaimer: The information provided in this article is for educational and informational purposes only. It does not constitute financial advice, investment recommendations, or trading strategies. Trading and investing involve risk, including the potential loss of principal. Before making any financial decisions, readers should conduct their own research and consult with a qualified financial advisor or investment professional.