Is Plus500 good for crypto? Discover it in our broker overview. Plus500 is a famous CFD provider in the trading world, with a strong presence. Plus500 Ltd is headquartered in Israel and has subsidiaries in the UK (Plus500UK Ltd), Cyprus (Plus500CY Ltd), Australia (Plus500AU Ltd), and Singapore (Plus500SG Pte Ltd). Notably, Plus500CY Ltd is authorized and regulated by the Cyprus Securities and Exchange Commission (Licence No. 250/14).

Plus500’s native country is listed as Cyprus in our database.

Plus500, which was founded in 2008, did not originally provide crypto CFDs because to the lack of cryptocurrencies at the time.

Plus500 is a CFD platform that specializes in derivative trading, specifically “CFDs.” Derivatives are assets whose prices are based on the value of another asset, usually stocks, bonds, or commodities. In the world of cryptocurrencies, these derivatives get their value from particular cryptocurrency values.

- Recommended broker

Our recommendation:

Invest with Plus500

Supported CFD Contracts

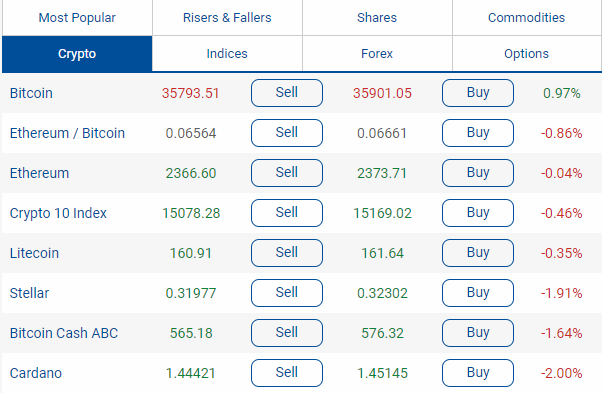

The crypto division of Plus500 provides trading opportunities in the following cryptocurrency-related contracts:

As seen in the example above, the site only provides trading via CFD contracts for the most established cryptocurrencies. It is crucial to remember, however, that the availability of these crypto CFD contracts is subject to applicable restrictions at any given moment.

US-investors

To our knowledge, Plus500 does not allow US investors to trade on its platform. Therefore, if you’re situated in the US and interested in crypto trading, you’ll need to seek alternate possibilities. Fortunately, you can use our Exchange List and filters to browse across exchanges depending on whether they allow US investors.

Mobile Support

While many crypto traders choose desktop configurations for best trading circumstances owing to bigger displays that can show more critical information at the same time, not all investors use desktops for their trading requirements. Some people enjoy the ease of trading from their mobile phones. If you fall into this group, you’ll be happy to hear that Plus500’s trading platform is mobile-friendly, with applications available for both iPhone and Android devices. This enables you to effortlessly trade cryptocurrency from your mobile device.

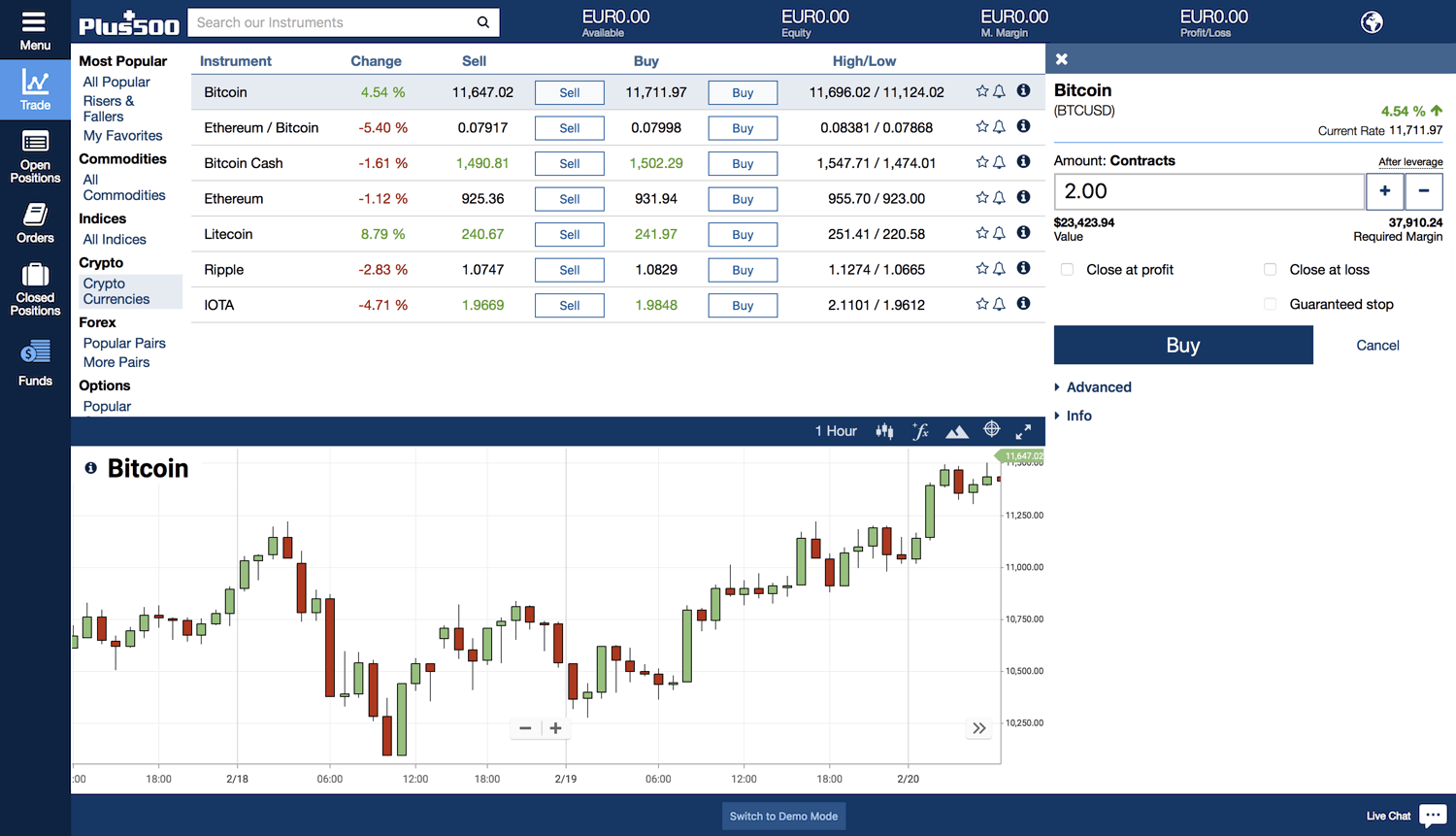

Plus500 Trading View

Various exchanges provide diverse trading perspectives, and there is no widely recognized “best” one. It is critical to establish which trading viewpoint corresponds to your tastes. Trading views often show the order book (or a piece of it), a price chart for the specified CFD contract, and order history. Additionally, they often incorporate purchase and sell boxes. Before committing to an exchange, review the trading perspective to verify it meets your requirements and preferences.

Below is an overview of Plus500’s trading view:

Finally, it is entirely up to you to decide if the above trading strategy is right for you. When it comes to trading experience, each trader’s tastes and needs may vary. Furthermore, trading platforms often include a variety of customization options, enabling you to tailor the settings to your own tastes. Take your time exploring the various options and customizing the trading view to meet your requirements and tastes.

Leveraged Trading

Plus500 provides leveraged trading options, which enable traders to magnify their holdings. They provide up to 2x leverage on cryptocurrency CFDs, 20x leverage on index CFDs, and 30x leverage on forex CFDs.

It is critical to remember that although leveraged derivatives trading may provide large rewards, it also carries considerable dangers. For example, imagine you have $10,000 in your trading account and intend to invest $100 in Bitcoin (BTC) as a long position (with the expectation that its value would rise), using 100x leverage. If BTC grows by 10%, your $100 investment will provide a profit of $10. However, with 100x leverage, your profit would be an extra $1,000 ($990 more than if you had not leveraged your investment). If BTC’s value drops by 10%, you will lose $1,000 ($990 more than if you had not leveraged your investment).

Understand that huge rewards and losses are possible.

Disclaimer: The example provided above is purely illustrative and not indicative of actual trading outcomes. Additionally, the highest leverage available for cryptocurrency CFDs on Plus500 is limited to 2x.

Is Plus500 Good for Crypto: CFD Fees

Trading costs at a CFD broker, such as Plus500, are organized differently than at centralized cryptocurrency exchanges. Here are the main fees to consider:

- Spreads: CFD brokers often charge spreads, or the difference between an asset’s buy and sell prices. This spread represents the broker’s reward for arranging the deal. The spread varies according to market circumstances and the individual item being exchanged.

- Overnight costs, also known as swap fees or finance charges, are charged for positions that are held overnight. CFD brokers may charge or credit traders, depending on the interest rate difference between the currencies involved in the transaction. These costs are charged for holding positions open overnight and vary based on the asset and position orientation (long or short).

- Inactivity fees: Certain CFD brokers charge inactivity fees on accounts that have been idle for an extended length of time. These fees are used to pay administrative expenses and may apply if there is no trading activity during a certain term.

Trading CFDs requires understanding and accounting for these fees, which may affect your profitability and strategy. CFD brokers’ fee schedules may vary, therefore, it’s vital to read them carefully.

Plus500 CFD Spread

A “spread” refers to the major charge connected with any CFD trading platform. Essentially, it is comparable to the trading costs charged by centralized cryptocurrency exchanges. The spread is the mark-up or mark-down applied by the platform when executing a transaction for a certain cryptocurrency CFD. For example, if the relevant CFD is priced at $100 with a 1% spread, the buyer may trade the crypto CFD on the platform for $101 (or sell it for $99). The difference between the sale price and the buy price (in this example, $1) generates money for the trading platform.

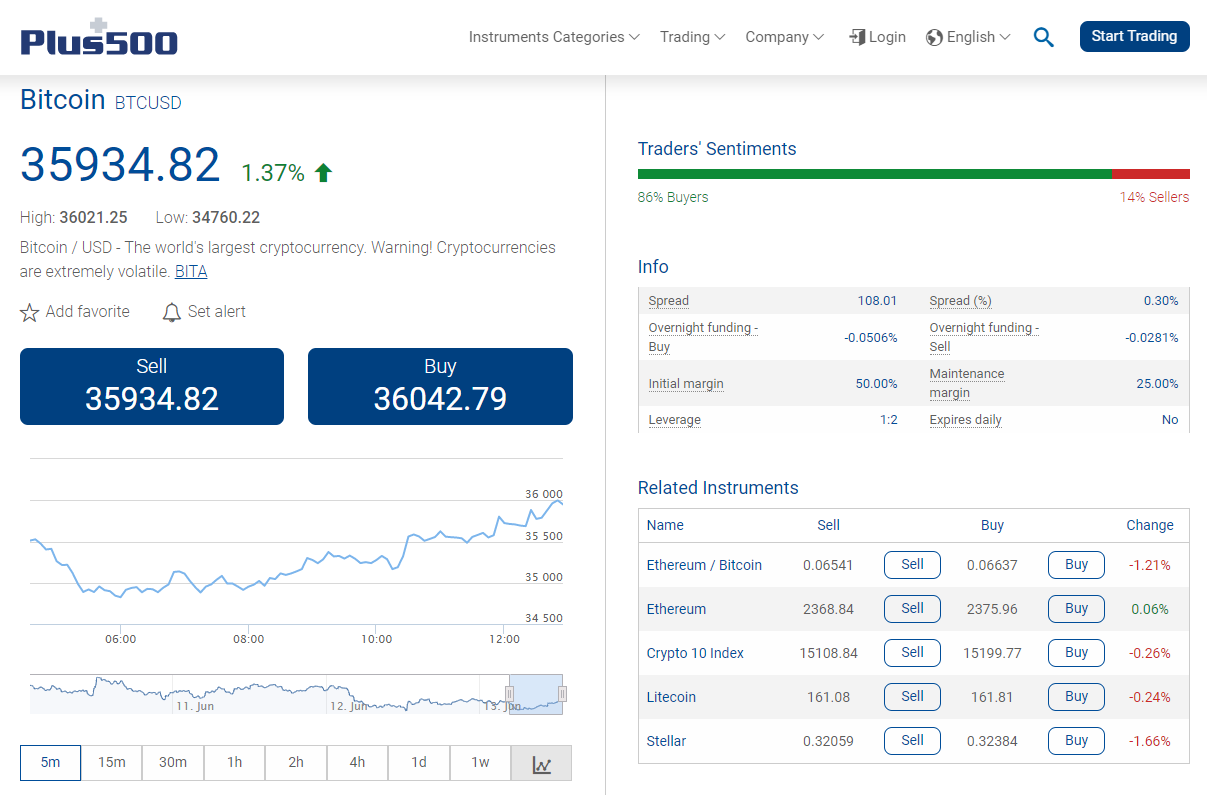

Plus500’s crypto CFDs had a spread of 0.30% as of the time this review was written, on June 13, 2021, at 14:00 CET. The graphic below shows the fees for a BTC/USD contract on Plus500 as of June 13, 2021, at 14:00 CET. It’s worth noting that the spread is classified as “variable” since it depends on the trading instrument and is constantly altered in reaction to market circumstances.

Plus500 CFD Overnight Fee

An overnight cost, also known as a swap fee or financing charge, is a fee charged by a trading platform when a trader keeps a position (such as a Crypto CFD) overnight. It is a simple cost imposed for each night that a job is available. While the costs are tiny, traders anticipate that winning positions will balance or surpass them as the value of their position increases.

Based on the BTC/USD CFD data above, a buy position overnight cost is 0.0506% of the order size, while a sell position costs 0.0281%. The trading platform’s main screen’s “Details” section next to the instrument’s name displays the overnight funding time and daily overnight funding %.

Plus500 CFD Inactivity Fee

When a trader does not check in to their trading account for a certain length of time, they will be charged an inactivity fee. At Plus500, this time is set at three months, with an inactivity cost of USD ten. While not one of the most substantial fees, we feel it is worth emphasizing since it may be seen as hostile to consumers. It’s worth noting that several CFD brokers follow similar rules. Plus500 notes that this price is meant to cover the expenses of offering the service, even when it is not actively utilized. It is vital to note that the inactivity cost applies to all accounts at Plus500, not only crypto CFDs. Furthermore, it is only collected when there are adequate cash in the user’s account.

Currency Conversion Fee

Plus500 charges a Currency Conversion Fee for any transactions involving instruments denominated in a currency other than the currency of your account. This charge is calculated in real time and included in the unrealized profit and loss of each open position.

Guaranteed Stop Order

This order type is unique and meant to help you control risk by providing a stop loss level. Using this function implies your position will close at the given desired pace, subject to a greater spread.

Plus500 Withdrawal fees

Plus500 runs on a contract basis, therefore, mentioning a BTC withdrawal cost is meaningless. Instead, the only withdrawals made are in fiat cash.

Each user account is limited to five (5) withdrawals each month, which are free. However, if any withdrawals exceed this limit, the platform may charge a fee of USD 10 (or equivalent) every excess withdrawal. Furthermore, withdrawals by bank transfer may incur a cost of up to $6 USD owing to bank processing fees.

This fee structure seems to be consistent with common procedures among CFD brokers.

Is Plus500 Good for Crypto: Deposit Methods

Plus500 allows you to deposit fiat cash via a variety of ways, including but not limited to VISA, MasterCard, Klarna, PayPal, Skrill, and more. This variety of payment alternatives is quite useful for consumers who want quick access to their trading platform. Remember that the availability of these payment options is subject to regulatory regulations and may change over time.

LEGAL RISK WARNING: Trading CFDs with this provider carries a high risk, as 77% of retail investor accounts lose money. It’s crucial to assess whether you can afford to bear the potential loss of your invested capital.